AI-Enhanced UX Core

Leveraging AI Across Design, Content, and Evaluation to Optimize Every Stage of Delivery

Build intelligent, efficient design workflows

Integrating AI across image generation, UX writing, and usability evaluation. Deliver optimized outcomes with reduced effort and faster turnaround.

My Role UX Strategy, AI Workflow Design, Image Content & Evaluation

Duration: 2 months

Goal:

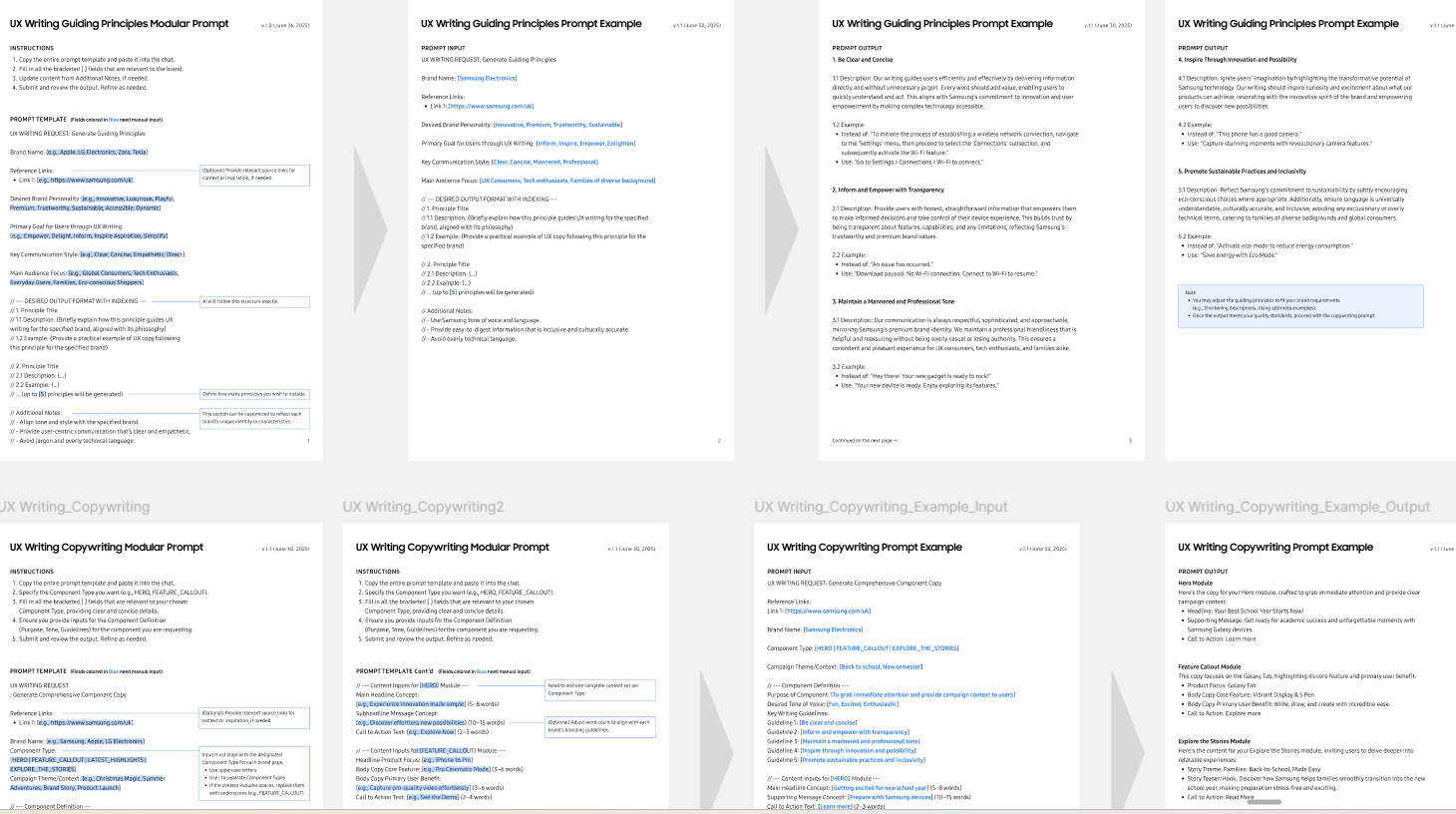

AIX is a future-ready UX framework powered by AI. By integrating AI into content creation, writing, and evaluation, the project reimagines how designers work—achieving more with less time, without compromising quality.

My Contribution:

I led the UX direction for this AI-powered initiative, focusing on integrating generative tools into real workflows. My role spanned from defining modular prompt templates for image generation and UX writing, to building evaluation flows that optimized output quality. I collaborated cross-functionally to prototype, test, and refine an AI-enhanced UX process that reduced turnaround time while maintaining design integrity.

Get StartedDesign for impact. Build for scale.

We created an AI-powered UX solution for teams working under pressure. Our goal: streamline workflows without sacrificing accessibility or quality.

The challenge? Users with varying digital skills all needed fast, reliable results.

The solution? Smart tools that empower teams to create, write, and evaluate at scale.

How can design teams leverage AI to compete with larger agencies while delivering high-quality UX at scale?

✅ Core AIX – Background & Goals

This project began with a clear need: help internal teams under pressure work faster without sacrificing quality.

By analyzing current workflows, we identified repetitive and time-consuming UX tasks across three key areas — image generation, UX writing, and evaluation. The goal was to develop a modular, AI-assisted process that empowered teams to focus on creativity, not just execution.

Unbanked Americans : Those who don’t make use of any banking services

Problems:

No access to digital banking

Way to many fees/fees are too high

No savings

No path to financial growth

Underbanked Americans: Around 20% of Americans are underbanked (~33% are millennials) according to the FDIC, which means they have either a checking or savings account, though rarely both.

Problems:

Limited / no credit visibility

Poor financial health leading fees & poor budgeting habits

Little to no savings

not using a full range of banking services

Persona

Connecting the dotsFinancial institution problems

Small local bank/ credit union

Limited resources and product offerings

Mid-sized bank

Limited digital resources, incentives benefits to compete with big banks

FI opportunities/goals?

Expand the demographic they serve

Retain customers (prepaid card users leave after 6 months on a card/product)

Convert customers to traditional bank users

Digital offering that allows them to compete with big giants

👉 DBX can help deliver a tailored experience to customize the feature set to make users feel at home. Mid-sized banks take the personal connection to their customer’s value into the digital space

DesignBring UI design into a better product

I started worked with other designers to prototype the new screens and UI visual refresh. This stage, where a lot of back and forth happened, spanned across the entire app & web project. I discussed the overall product vision with the design director, and POs prototyped and tweaked UI treatments with designers.

Color palettes

These new upgraded colors provide clients a more dynamic look, which enables customization to match FI’s brand colors.

deliveryKeep on iterating with user feedback for product excellence

Dashboards (one account)

New quick action icons highlight the big change to the dashboard. A slight pattern in the back of the available balance card has been added to match the splash screen pattern.

Nudges have been sized a bit larger and have graphics remove to place focus on the communication and call to action. This section has been named “My updates” and a badge to indicate the number of nudges added. Pattern matching our login screen used to tie visual language together.

Spending insights now come with more vibrant system colors to help catch user’s attention.

Hub screens

Layout has been re-designed to reduce whitespace and make each menu item look more tappable. Each item contains a quick action that is brand configurable. The hub screen has the flexibility to be split by pay & load features, or can be combined for just one hub for all money movement features.

addressing feedbackNavigation Testing

To decide which concept to suggest, we conducted the First Click Test

Measure where people expect to find X

Understand user expectations for feature location

Collect insights on expectation vs reality

understand the thought process for locating a feature

How we collected insights

Conducted first click test with 10 participants

showed 5 participants Concept A, 5 Concept B

Gave them two tasks - collected feedback on where they would click and why

Gathered their reactions to screen compared to their expectations

Why only one test?

Eliminate bias from order concepts are shown

Task one

You need to pay a bill that’s due tomorrow. Where would you tap on the screen to begin the process of paying your bill?

Task two

Your account balance is low and you need to transfer money into your account. Where would you click to begin this process?

Synthesizing resultsHow we did it

We logged feedback collected from interviews on a google sheet, then individually reviewed results & noted our own insights. Affinity mapping created with each individual’s insights- looking for trends/overlaps. As a result, we collaboratively landed on a decision with the help of insights

Synthesizing results #2Insights gathered

Deposit & Pay labels were somewhat confusing or misleading

Users expected multiple features to be nested inside of Move Money

Direct deposit adds confusion and a sense of uneasiness (4/10 mentioned)

A user found our app to seem easier and simpler than their current banking app (7/10 mentioned)

The Verdict

Merge tabs into “Move Money”

Clarity: Reduce the need for users to decide which tab to tap

Versatility: Works well for when we have few options as well as many

Simplicity: Makes White-label configuration easier, consolidates two variables into one

Assistance: Use section to assist in finding right feature

TakeawaysCollaborate and be visible

Effective and efficient communication with cross-functional roles was one of my big takeaways. I also learned how to make my rationales and work visible as a designer to the larger team to get feedback from more comprehensive perspectives.